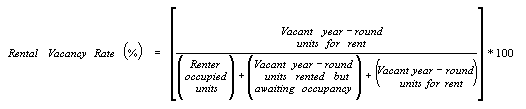

Calculating Vacancy Rates

All rental property investors/owners know that part of the process of selecting the best location(s) for rental properties includes the calculation of annual vacancy rates. Investors know all too well that they must calculate the average percentage of the year that properties will sit empty in order to make the best decision about where to purchase units. Why? Because vacancies are one of the greatest expenses for landlords and owners.

Rental Vacancy Rate Equation

While there is no set number for determining a decent rate of vacancy, the average rate throughout America is roughly 7.6%. Of course, the rates are variable depending on zip codes, however vacancy rates should always be factored into all rental property investment strategies. In addition, vacancy rates are heavily affected by the style in which a property is managed.

If mathematical formulas and algorithms are not your thing, there is a much simpler process for determining average vacancy rates.

The U.S. Census Bureau is a mecca of helpful info as the entity utilizes a data point system in order to track vacancy rates. In addition, the Bureau keeps tabs on the 75 greatest markets in America. While the data isn't the most "refined" and requires downloading in a spreadsheet format, it is helpful, yet does not get specific regarding neighborhoods, so consider consulting a real estate agent, too.

In some cases, particular zip codes rely on realtors to supply tenants for vacant units. Any realtor worth his or her salt would be equipped to provide a CMA (comparative market analysis) upon request. A CMA is full of useful statistics including average number of days vacant properties sit on the MLS prior to occupancy. You can also observe info such as listing prices, rental prices and other important information on the CMA.

If you'd like even more information, property managers and landlords are a great source, if not the best source, of info regarding vacancy rates. It is not unusual for such professionals to rattle off numbers by memory according to streets and specific neighborhoods. The perk to this approach is the ability to sniff out great property managers who are well equipped to handle your property investment assets.

As in any case, it is always best to do the research up front!